Running a retail business is exciting, but keeping track of expenses can feel overwhelming.

Between inventory costs, rent, payroll, and unexpected expenses, your revenue can vanish before you even realize it. This makes managing expenses effectively crucial to maintaining profitability and ensuring long-term success.

To effectively manage expenses as a retail business owner, the key strategies are to categorize them using a system, track all the expenses regularly, and review them often to identify opportunities for minimizing costs.

Effective expense management is the foundation of financial stability for any business. Without a clear understanding of where your money is going, it’s easy to:

Retail business owners face unique challenges, such as fluctuating inventory costs, seasonal demand, and high overhead expenses.

Without proper tracking and categorization, these expenses can spiral out of control, leading to cash flow problems and unnecessary financial strain.

By proactively managing expenses, businesses can identify cost-saving opportunities, make informed decisions, and allocate resources more effectively.

With the right systems – such as BizKit – you can gain wider visibility into your spending, reduce waste, and ultimately boost your bottom line.

Here are 3 practical strategies to help you take control of your business expenses and improve financial efficiency.

One of the biggest challenges in managing business expenses is not knowing where your money is going. Using an expense tracking system like BizKit can help you categorize all your expenditures into specific accounts, making it easier to analyze spending patterns and identify areas for cost-cutting.

When categorizing expenses, consider breaking them down into key areas, such as:

Organizing expenses into categories allows you to pinpoint where you’re overspending and make strategic adjustments.

Automated tracking solutions, such as those offered by BizKit expense tracking, can simplify this process, reducing the manual effort required to keep your finances in check.

Tracking every financial transaction—no matter how small—is essential for maintaining an accurate picture of your business’s financial health.

As retail business owners deal with a high volume of daily transactions, recording all income and expenses in real-time is crucial. Ignoring small transactions can lead to discrepancies that add up over time.

To stay on top of your finances:

With consistent tracking, you can identify trends, catch errors early, and avoid cash flow surprises that could disrupt your business operations.

Expense management is not a one-time task — it requires ongoing evaluation.

Reviewing your expense reports at the end of each week allows you to stay proactive in managing your finances and making any necessary adjustments before problems arise.

By analyzing your weekly reports, you can:

Regular reviews also help you set realistic financial goals, ensuring that you maintain profitability while keeping operational costs under control.

Leveraging financial insights from tools like BizKit can make this process more efficient and provide valuable recommendations for optimizing your business spending.

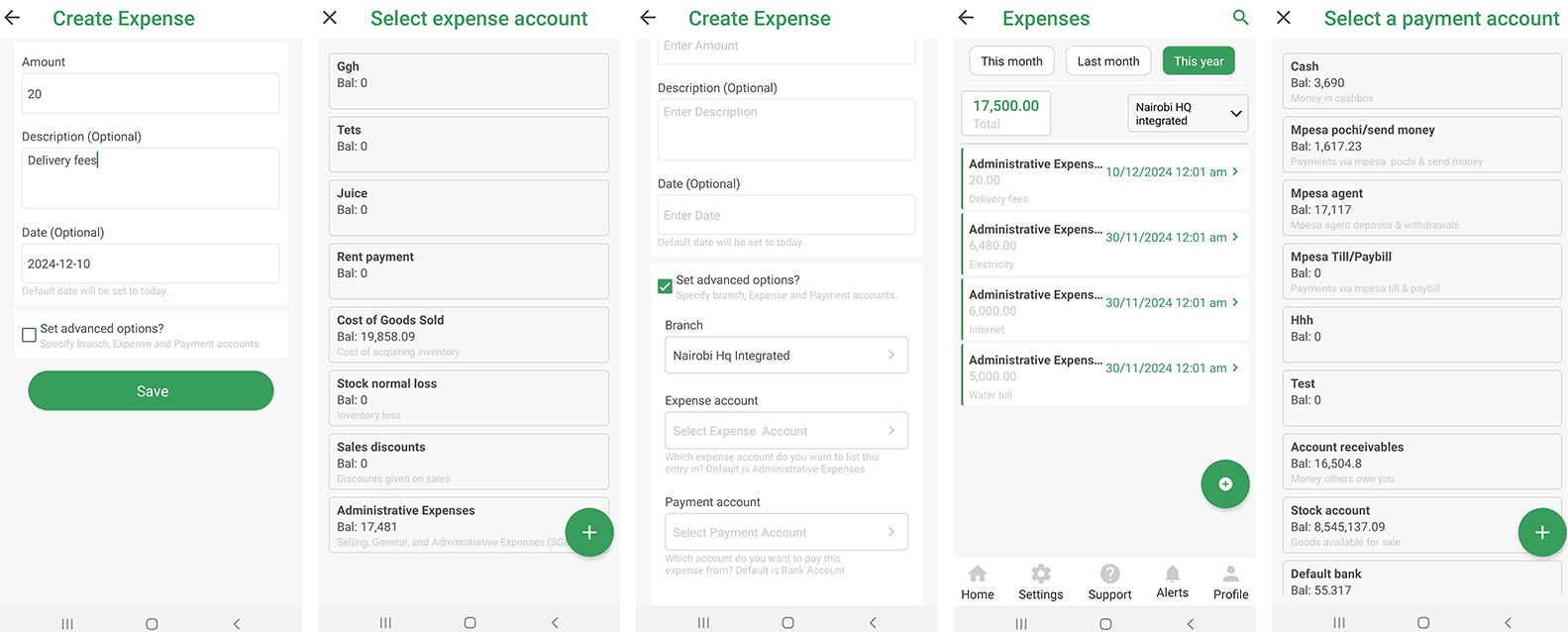

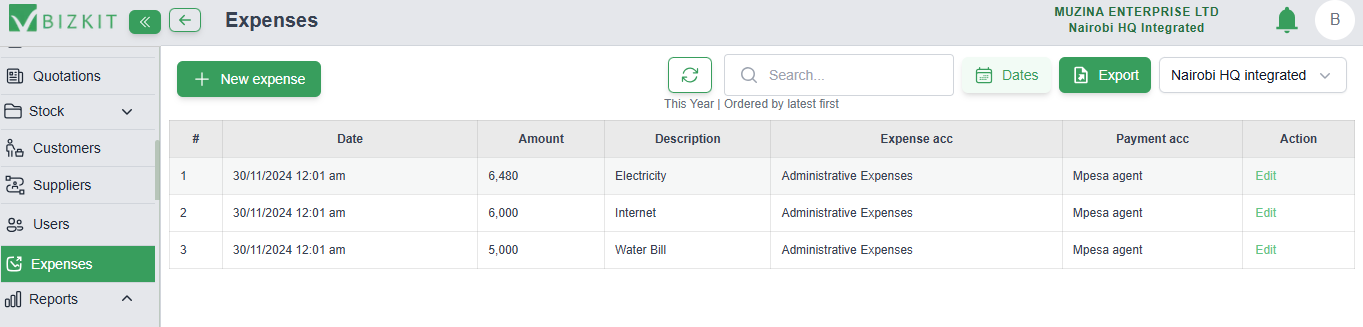

You can use Bizkit to manage your business expenses. BizKit helps you keep all your business expenses in one place, making it easier to monitor and manage your spending.

BizKit POS software helps businesses track unpaid expenses, allocate costs to the correct accounts, and monitor payment sources for better financial visibility.

By identifying major cost areas like rent, discounts and goods sold, BizKit ensures accurate expense tracking, improves cash flow management and keeps your finances organized and transparent.

Here is how BizKit expense management works:

With Bizkit, you’ll understand your business’s financial health and ensure financial stability by allocating your expenses accurately.

Many retail business owners often ask, “Where did all my money go?” The truth is that without proper expense management, profits can slip away unnoticed.

By categorizing expenses, tracking transactions regularly, and reviewing your expense reports, you can gain full control over your business finances and understand your financial health.

With the right strategies and tools like BizKit POS, managing your expenses doesn’t have to be overwhelming — it can become a streamlined, effortless process that drives long-term success.

Need more control over your business expenses? Switch to BizKit, the most comprehensive, easy-to-use POS system. Try BizKit Free

How to Efficiently Manage Multiple Branches for Your Retail Business

7 Must-Have POS Features to Streamline Your Retail Business

5 Simple Tips to Manage Your Retail Business Better in 2025

Where is My Money Going? 3 Smart Tips for Retail Business Owners to Manage Expenses Effectively